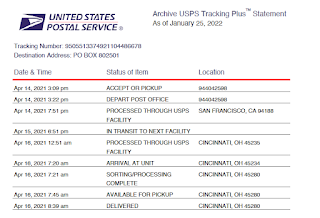

We had mailed the return timely on April 14, 2021, along with a check for $2,378 and Form 1040-V, the payment voucher.

Everything was in the same envelope. Obviously they cashed the check and knew it was ours. How could the return have been "lost"?

The above question is sarcastic, dear reader. My mother's 2019 and 2020 tax refunds still have not been received, and getting through to talk to a live person who knows what he or she is doing is impossible.

|

| Tracking info to Cincinnati |

So I did what we used to do in the old days: compose a politely worded business letter, free of tone, especially sarcasm.

The letter explained that the return was mailed at the Foster City Post Office and, according to the enclosed USPS tracking record, was received in Cincinnati on April 16th. Your move, IRS.

Note: the Washington Post reports that we are in the same boat with an unspecified number of taxpayers. [bold added]

As of Dec. 31, the IRS had 6 million unprocessed individual returns, including returns for the 2020 tax year...

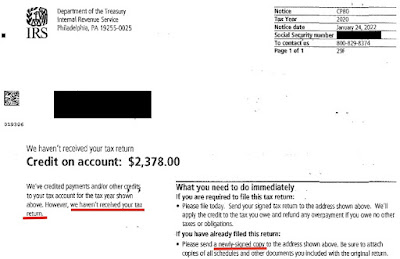

Many taxpayers have been receiving what’s called a “CP80 Notice.” Taxpayers who had already filed a return are told to send a newly signed copy to the address listed in the notice.

Obviously, this direction has alarmed those taxpayers who conclude their original returns are probably in a pile in some IRS office waiting to be processed. Wouldn’t mailing another return just cause more confusion?

No comments:

Post a Comment