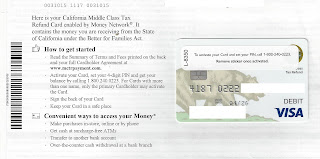

The California Middle Class Tax Refund (MCTR) card came three weeks ago. It was time to get the money.

From news reports scammers are able to drain the account after the card is activated, so I delayed that move until I was ready to use the card.

At the local Citibank branch this afternoon, I phoned the 1-800 number on the sticker and dutifully typed in the last six digits of my social security number. A computerized voice instructed me to create a 4-digit PIN, at which point it specified the card value.

The teller asked me to insert the Citibank ATM card, input its 4-digit PIN, then insert the MCTR Visa card and type its 4-digit PIN. I said that I wanted the entire amount transferred to my checking account. The teller said that the maximum daily amount was $600 (unclear if that was a card or Citibank limitation). He transferred that sum immediately and suggested that I come back tomorrow to claim the rest.

Fearful of waiting another day, I drove to the Bank of America branch to deposit the remaining funds. After I inserted the BoA ATM card and PIN, the teller inspected my driver's license, then processed the MCTR card. She took more time with the forms than the Citi teller. In the end all was well; the rest of the money was put into the checking account.

Comments:

1) Neither bank imposed a transaction fee.

2) The fund-draining scam clearly isn't occurring at the bank branches but at other venues, like online merchants, where Visa cards can be used.

3) Today the IRS finally ruled that the MCTR payments are not taxable by the Federal government (California declared them not to be taxable by the State last year).

4) I don't see why the Franchise Tax Board couldn't issue checks, like it did in the old days. Theft losses will still occur, but the crooks will have a much harder time.

No comments:

Post a Comment