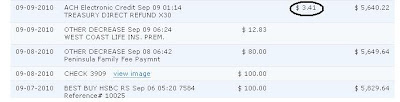

Yesterday I went down to my friendly neighborhood stockbroker and converted some of the money in my regular IRA to a Roth IRA. Withdrawals from the former are included in taxable income, while Roth distributions are completely tax-free. Converting part or all of a regular IRA to a Roth counts as a taxable distribution, so during those few minutes I increased our 2010 tax bill by thousands of dollars. I won’t reap the benefit, if any, for many years.

A Roth conversion is a complex financial decision:

How much you gain from converting depends on your own economic situation, when you take Social Security, whether tax rates are increased, the general pattern of your marginal tax rates, and your ability to alter your future tax rates.I executed the Roth conversion because of optimism. I’m hopeful that my fund and stock investments will increase by a lot (in the financial dictionary that's more than a smidgeon) and that my tax bracket, even in retirement, will be high for the “good” reason that high income would push me into a high tax bracket. [The “bad” reason would be that tax rates would go up on the same income brackets due to the government’s fiscal problems. Of course, if the situation became really dire, then the Roth distributions might be (double) taxed, and conversions in retrospect would appear dumb.]

Like I said, I’m an optimist. Happy New Year!